MAY 2024

REAL ESTATE MARKET UPDATE

CONTACT US:

425-236-6777

Washington Housing Market Heats Up Despite Higher Borrowing Costs

Home buying and selling are picking up in Washington state, just like they normally do in the spring and summer. This is good news, but there's a catch: interest rates are a little higher now (around 7%) than they were last year. This means some people might find it harder to afford a house, and others might be hesitant to sell their current low-interest-rate mortgage.

Even with the higher rates, there are some positive signs:

Overall, the Washington housing market is adjusting to the new normal of higher interest rates. There's more activity, but it might take some time for prices to settle down.

Home buying and selling are picking up in Washington state, just like they normally do in the spring and summer. This is good news, but there's a catch: interest rates are a little higher now (around 7%) than they were last year. This means some people might find it harder to afford a house, and others might be hesitant to sell their current low-interest-rate mortgage.

Even with the higher rates, there are some positive signs:

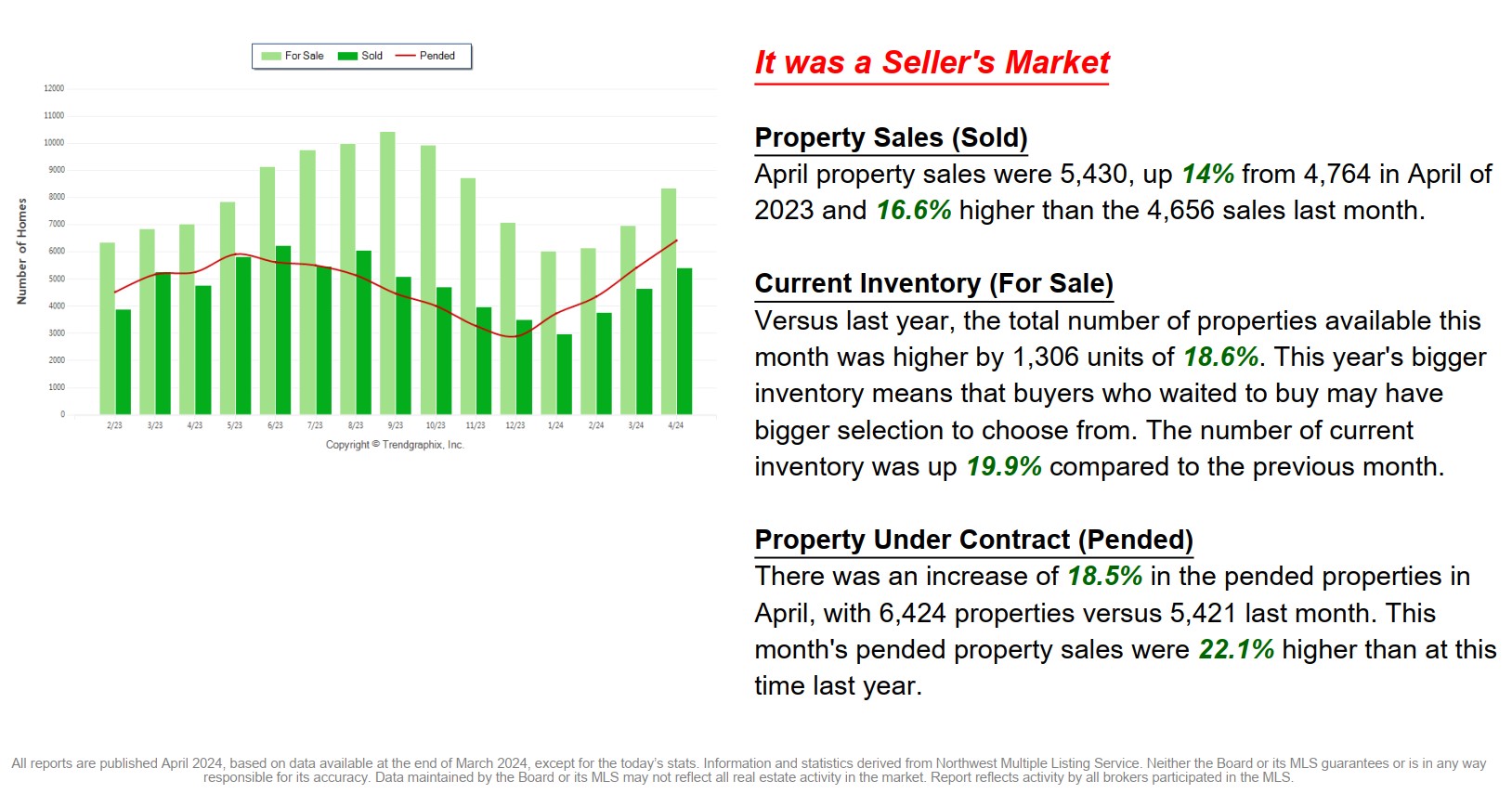

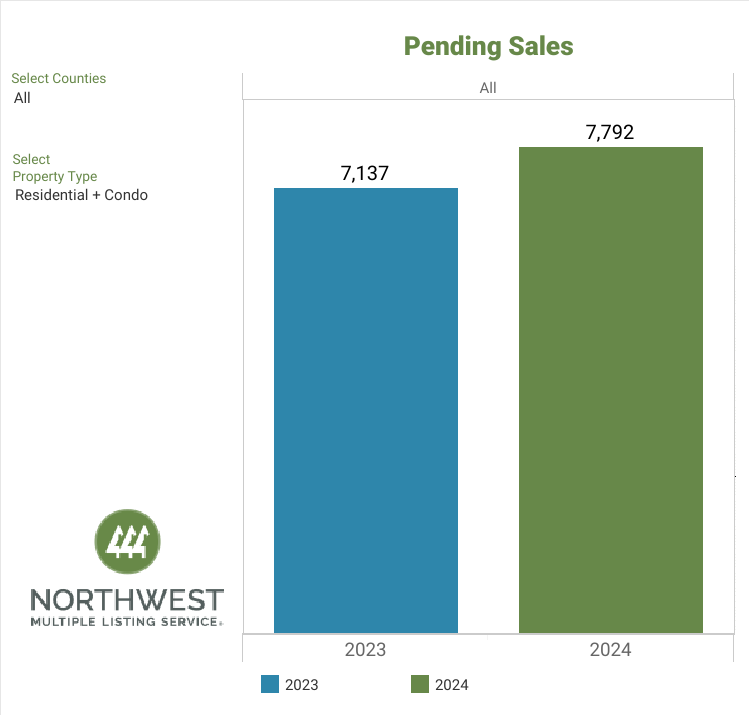

- More homes were sold in April 2024 compared to April 2023 (almost 10% more!).

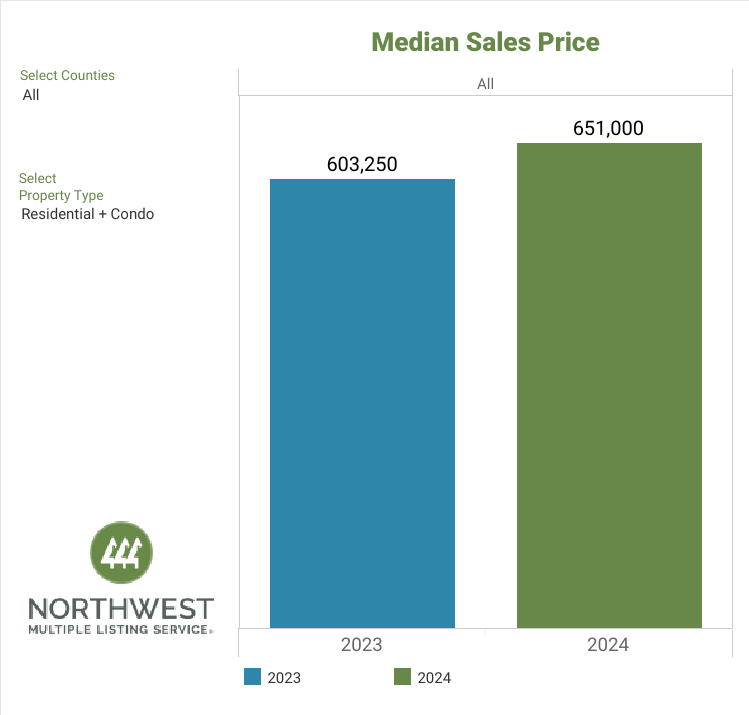

- Prices went up in most counties (almost an 8% increase on average).

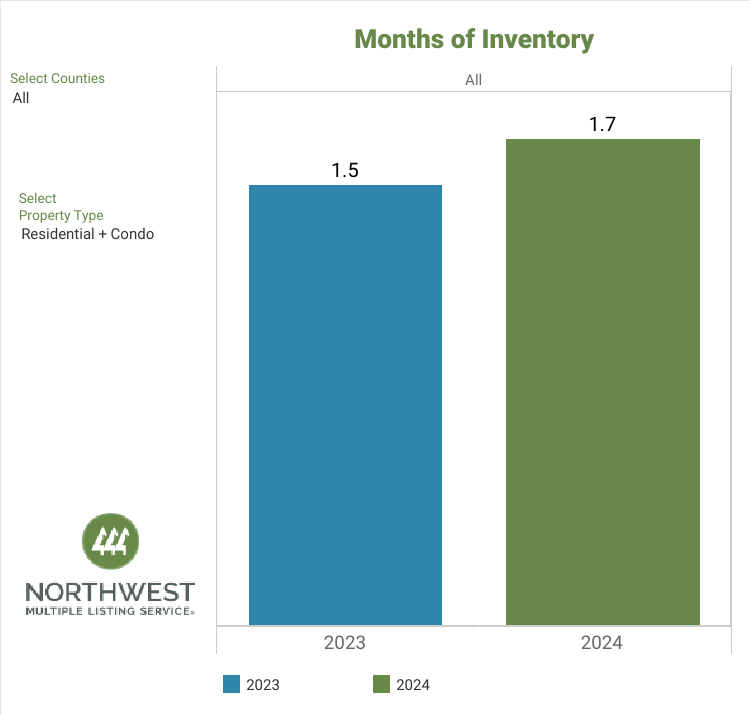

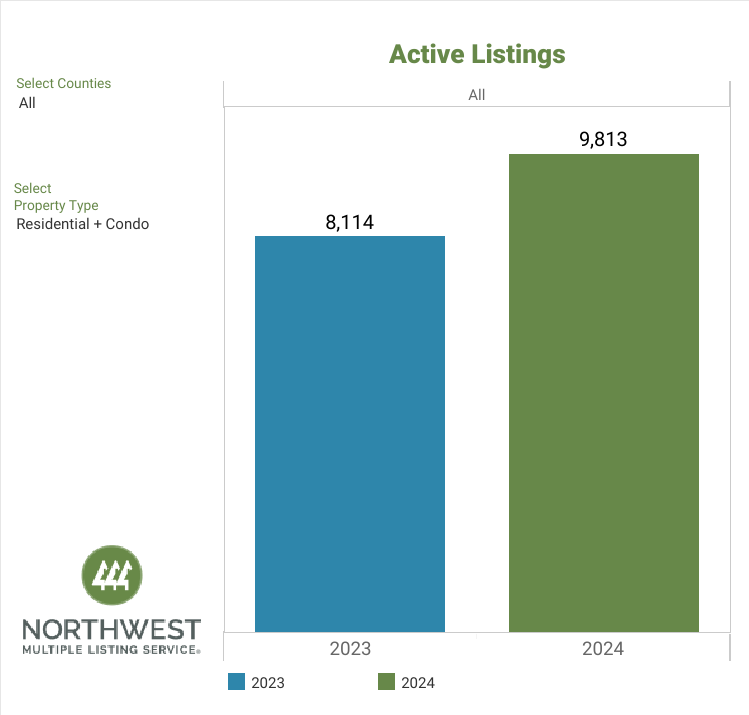

- There are more houses for sale now than there were last year (almost 21% more!), which might help slow down price increases in the coming months.

- The most expensive counties to buy a house in are San Juan, King, and Snohomish (over $738,000).

- The most affordable counties are Grant, Adams, and Okanogan (under $340,000).

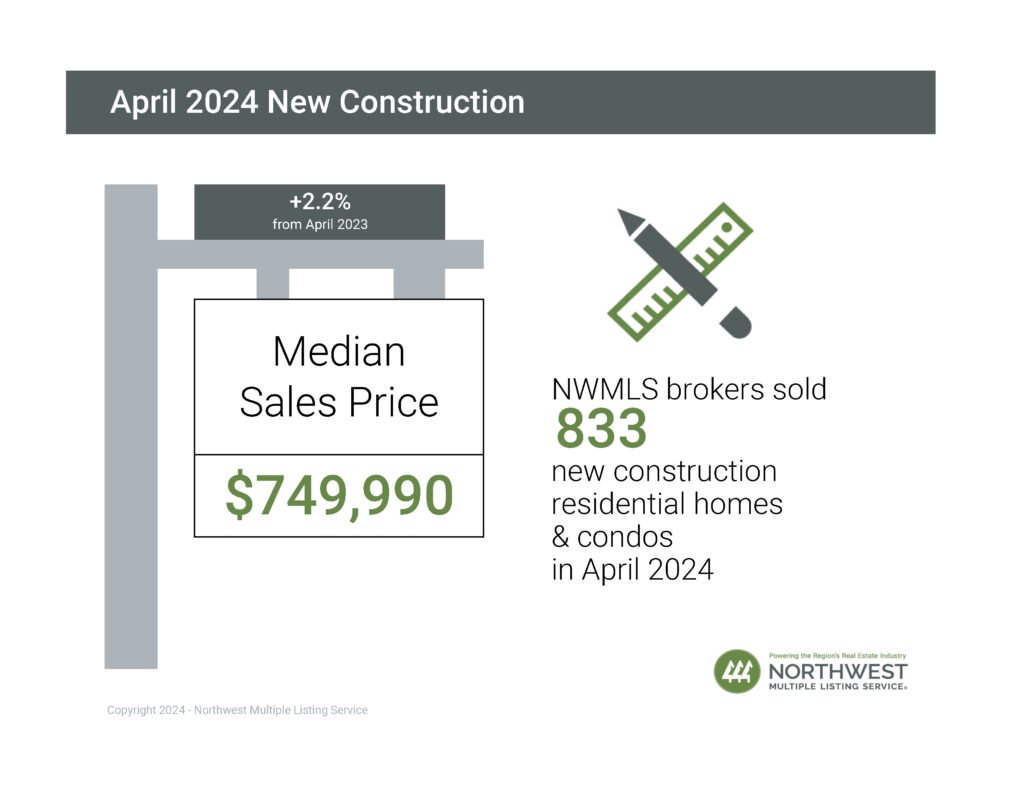

- Condos are also selling well, with prices and sales both going up.

Overall, the Washington housing market is adjusting to the new normal of higher interest rates. There's more activity, but it might take some time for prices to settle down.

NWMLS Market Snapshot - APRIL 2024

George Moorhead of Bentley Properties talks about Inflations Causing Rates To Go Up and Is The Real Estate Market Crashing? Plus, Top 5 Things You Need To Look For When Getting Mortgage Rates